Businesses are constantly under pressure to provide outstanding customer experiences in the rapidly changing financial services industry while upholding compliance and streamlining operations. To address these issues, Salesforce, a well-known customer relationship management (CRM) platform, provides robust solutions for financial Organizations. This blog examines how Salesforce for financial services transforms the industry and provides information on its uses, advantages, and best practices.

A Recognition of Salesforce for Financial Services

Salesforce for Financial Services is a suite of tools designed to meet the specific needs of financial institutions, including banks, insurance providers, wealth management firms, and others. Financial organizations may enhance customer service, increase efficiency, and simplify processes by utilizing industry-specific tools and basic Salesforce features.

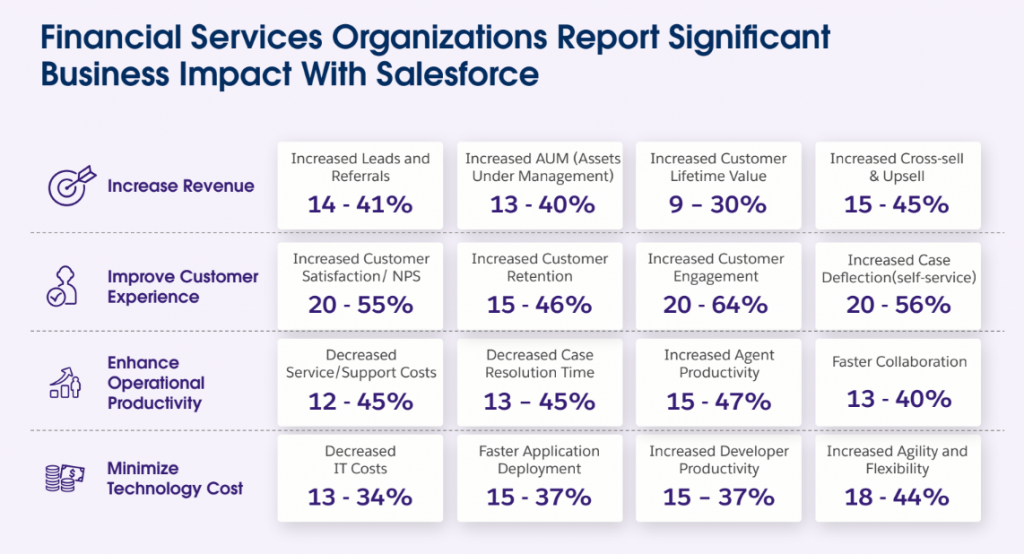

Image Source: salesforce.com

The Most Important Salesforce Features for Financial Services

Financial Services Cloud (FSC): FSC is the core of Salesforce’s financial sector offering. It provides a single platform for managing client interactions, financial goals, and contacts across numerous media.

Einstein Analytics: Financial organizations can harness the power of this advanced analytics solution to personalize client interactions and make informed, data-driven choices. By integrating it with FSC, it provides predictive insights, empowering financial professionals with foresight and control.

Salesforce Shield: Salesforce Shield provides improved security and compliance capabilities, such as encryption, audit trails, and event monitoring, for organizations managing sensitive financial data.

Einstein AI: Salesforce has integrated artificial intelligence features that improve customer service and operational efficiency by automating tasks, anticipating customer needs, and making recommendations.

Possible Applications of Salesforce in Financial Services

1. Customer Relationship Management (CRM)

Salesforce’s ability to manage client interactions is aided by its 360-degree customer view. This holistic approach, which incorporates account information, transaction history, and interactions across all touchpoints, enables proactive engagement and personalized service.

Use Case: By leveraging FSC to track client portfolios, automate routine tasks, and identify investing opportunities, advisors can focus on high-value interactions.

2. Streamlining Operations

Financial organizations frequently handle intricate procedures that Salesforce can help to streamline. Task management, integrated systems, and workflow automation decrease manual labor and boost productivity.

Use Case: By automating the loan application process, a bank may utilize Salesforce to speed up response times and increase customer satisfaction. This includes document collection and approval.

3. Compliance Management

Salesforce’s compliance management capabilities, which offer safe access controls, data encryption, and audit trails, assist financial institutions in meeting regulatory requirements.

Use Case: Salesforce Shield is a tool that an insurance business may use to track data access and modifications and make sure that it complies with industry rules like the CCPA and GDPR.

4. Marketing and Sales Automation

Salesforce’s marketing and sales features enable financial organizations to create targeted campaigns, manage leads, and track sales performance—all of which contribute to effective client acquisition and retention strategies.

Use Case: Retail banks can deliver tailored marketing messages and offers to specific client segments by using Salesforce Marketing Cloud to segment customers based on their financial behaviors and preferences.

5. Customer Support and Service

Salesforce provides comprehensive customer support solutions, including knowledge bases, omnichannel assistance, and case management. Financial organizations can offer prompt and effective customer service with the use of these characteristics.

Use Case: Salesforce Service Cloud enables an insurance company to track client complaints, handle claims, and offer resolutions via chat, email, and phone.

Conclusion:

Financial organizations may manage client interactions, optimize operations, and maintain compliance with the aid of Salesforce for Financial Services, which provides an extensive tool suite. Financial institutions may use Salesforce to increase productivity, improve client experience, and maintain competitiveness in a changing market.

Embracing advanced technologies like Salesforce is a strategic move for financial institutions to stay competitive in the evolving financial services sector. Salesforce’s adaptability, scalability, and cutting-edge functionality are tailor-made for businesses in today’s dynamic market, be it banks, insurance providers, or wealth management firms.