The Evolution of Customer Expectations in Financial Services

With the evolution of digital experiences, today’s customers expect personalized financial advice rather than one-size-fits-all products. Traditional financial institutions have relied on demographic segmentation (age, income, geography) to classify their customers. However, this method lacks depth in understanding customer intent, life goals, and behavioral patterns.

Behavior-based segmentation provides a more dynamic and real-time approach to customer segmentation by analyzing how customers interact with financial products, their spending habits, major life milestones, and financial goals. Salesforce Financial Services Cloud (FSC) helps financial institutions leverage behavioral data to offer personalized recommendations that align with a customer’s life stage and financial needs.

Challenges Faced by Financial Institutions

- Lack of Personalization – Customers receive generic product offerings that may not align with their needs.

- Fragmented Customer Data – Data is siloed across different departments, making it difficult to get a unified view of the customer.

- Inconsistent Customer Engagement – Financial institutions often struggle to proactively engage customers at key life stages, such as marriage, buying a home, or retirement planning.

- Missed Cross-Sell and Upsell Opportunities – Without behavioral insights, institutions fail to provide relevant product recommendations.

Leveraging Salesforce Financial Services Cloud for Behavior-Based Segmentation

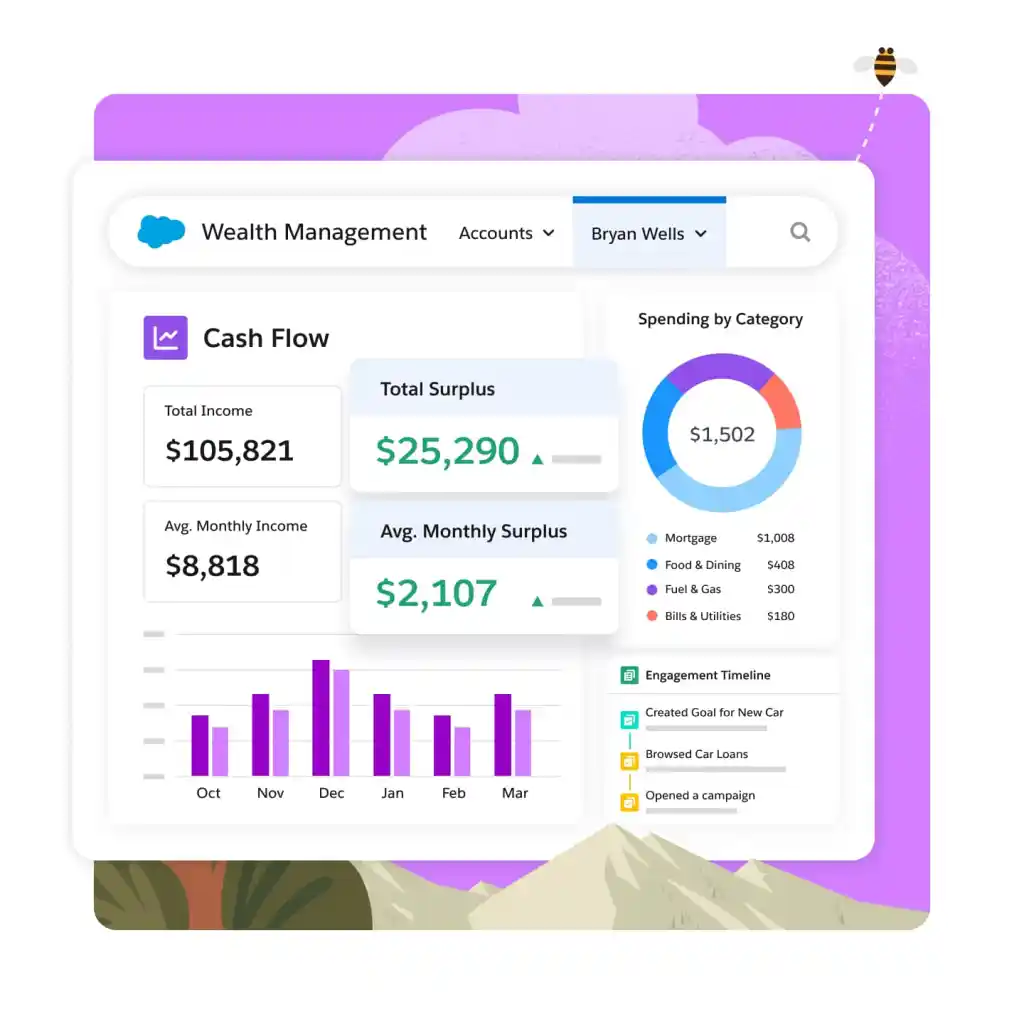

Customer 360 – A Unified Customer Profile

Salesforce FSC unifies customer interactions, transaction data, lifestyle changes, and financial behaviors into a single Customer 360 view. By leveraging Einstein Analytics and AI-driven insights, financial institutions can segment customers based on:

- Spending & Saving Behavior – Identify customers who frequently invest, save, or have discretionary spending habits.

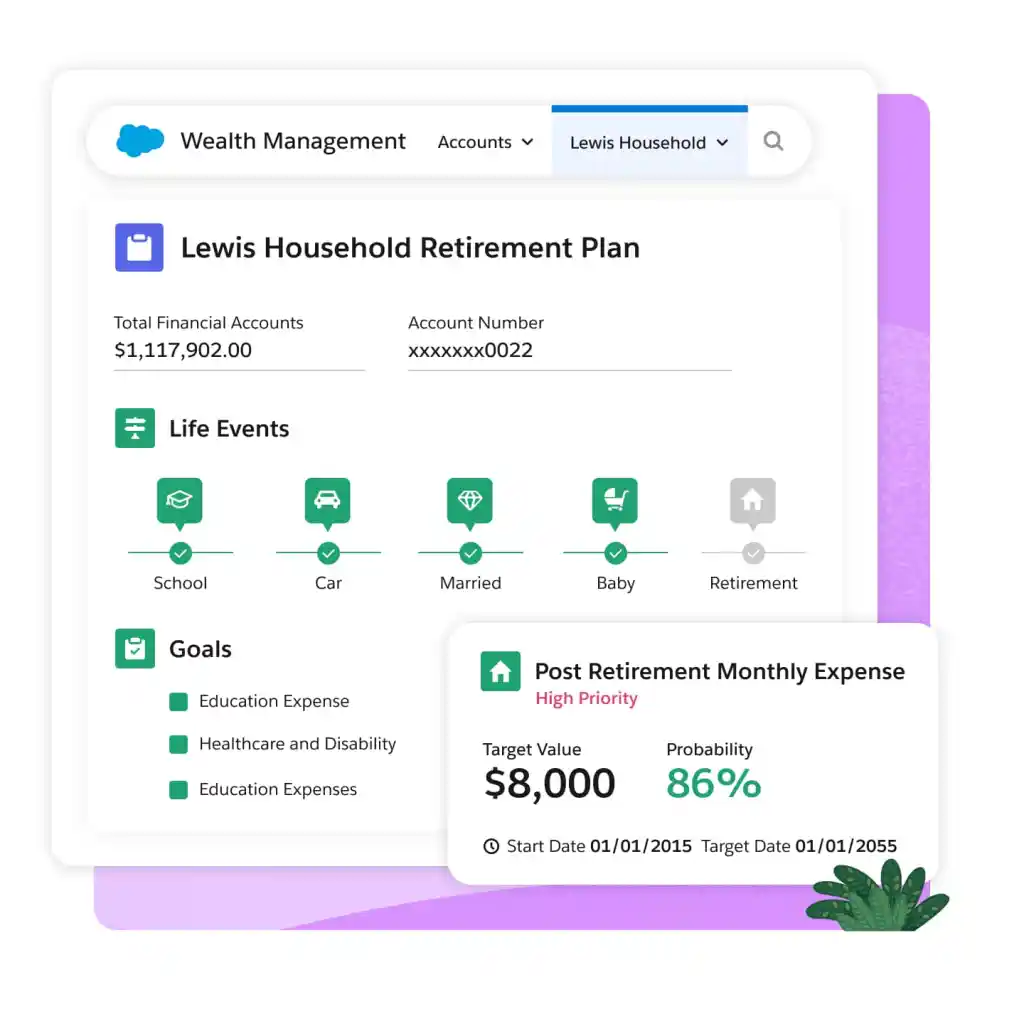

- Financial Milestones – Detect life events such as homeownership, marriage, or retirement.

- Product Interaction Patterns – Track how customers engage with financial products (e.g., interest in wealth management services or frequent credit card transactions).

- Engagement Levels – Identify highly engaged customers vs. those who require re-engagement efforts.

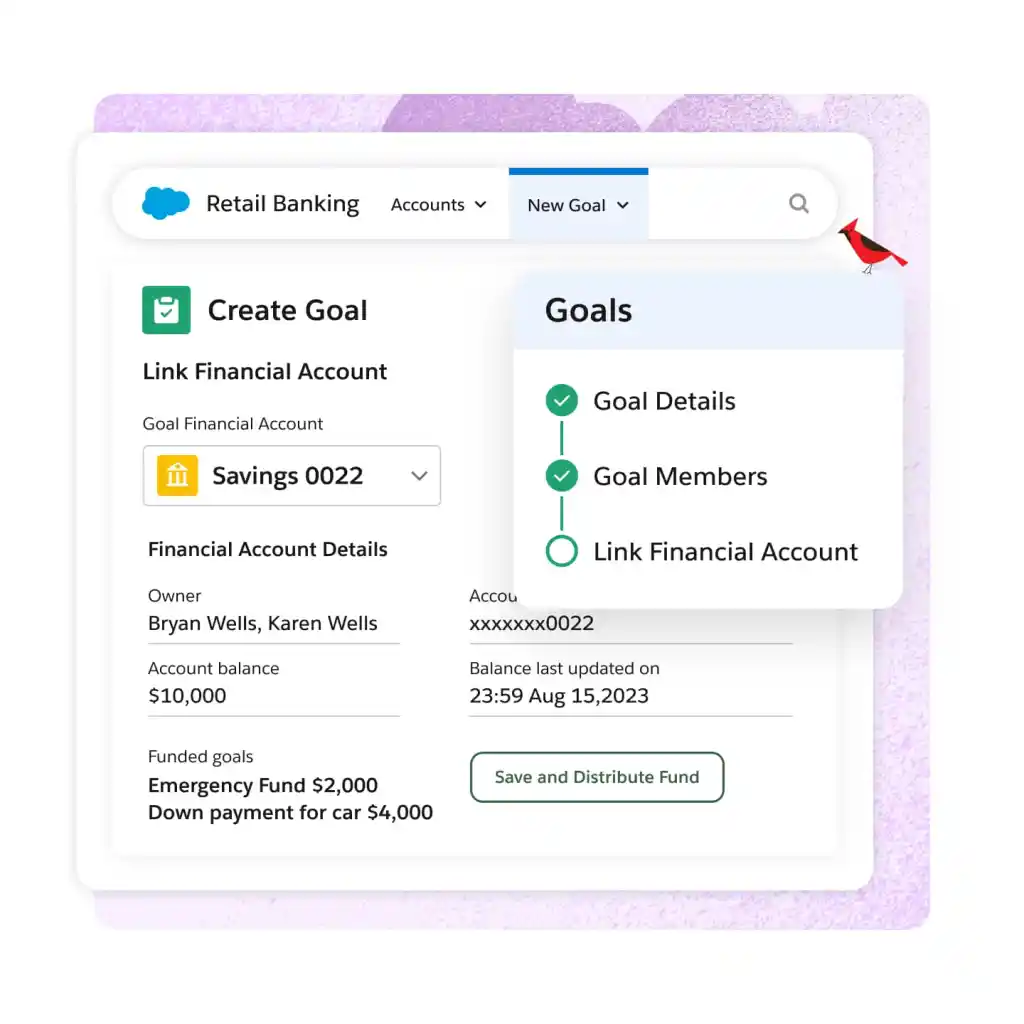

Personalized Financial Product Recommendations

With Einstein Next Best Action, Salesforce FSC uses AI-driven insights to recommend financial products based on behavioral segmentation. Examples include:

- Young Professionals (Early Career Stage): Personalized credit-building tools, student loan refinancing options, and first-time investment plans.

- Newly Married Couples: Joint bank accounts, life insurance, and home mortgage advisory services.

- Growing Families: Child education savings plans, family health insurance, and estate planning.

- Pre-Retirement Stage: Retirement funds, annuity products, and tax-saving investment strategies.

Actionable Insights for Financial Advisors

FSC empowers relationship managers, advisors, and agents with real-time insights to proactively engage customers at critical financial decision-making moments. Advisors can leverage:

- Einstein Prediction Builder – To forecast a customer’s likelihood of purchasing a specific financial product.

- Automated Action Plans – To provide step-by-step guidance for advisors when reaching out to a segmented customer group.

- Referral and Lead Management – To ensure high-value clients receive priority handling and customized financial plans.

Enhancing Customer Experience Through Smart Segmentation

Instead of reacting to customer needs, FSC enables financial institutions to anticipate and proactively offer financial solutions. This leads to:

a) Higher Customer Satisfaction – Customers feel valued with personalized financial guidance.

b) Increased Customer Retention – Timely and relevant engagement prevents churn.

c) Improved Revenue Growth – Intelligent cross-selling and upselling through predictive analytics.

d) Operational Efficiency – Automation of client segmentation reduces manual efforts and enhances productivity.

Conclusion

Behavior-based segmentation is transforming how financial institutions understand and serve their customers. Salesforce Financial Services Cloud enables financial firms to deliver hyper-personalized recommendations, helping clients navigate their financial journey at every life stage. By leveraging AI, automation, and real-time insights, FSC ensures that financial services firms stay competitive in the digital era and foster deeper customer relationships.

Reference Links & Supporting Salesforce Help Documents

Salesforce Help Documentation:

- Financial Services Cloud Overview

- Einstein Next Best Action

- Customer 360 Data Model

- Action Plans in FSC

- Einstein Prediction Builder

Additional References:

Authors: Seshank Evani