Businesses are always under pressure to provide outstanding customer experiences in the rapidly changing financial services industry while upholding compliance and streamlining operations. To address these issues, Salesforce, a well-known customer relationship management (CRM) platform, provides strong solutions designed specifically for financial Organizations. This blog examines how Salesforce is transforming the financial services industry and provides information on its uses, advantages, and best practices.

A Recognition of Salesforce for Financial Services

A set of products called Salesforce for Financial Services is intended to address the particular requirements of financial organizations such as banks, insurance companies, wealth management businesses, and others. With the help of industry-specific tools and fundamental Salesforce functionalities, businesses can manage client interactions, improve productivity, and streamline procedures.

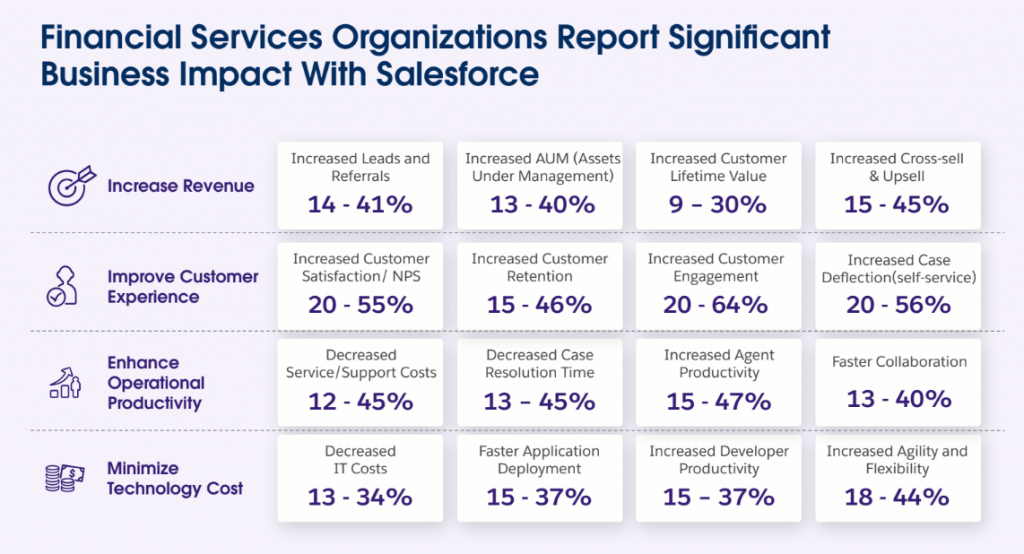

Image Source: salesforce.com

The Most Important Salesforce Features for Financial Services

Financial Services Cloud (FSC): FSC is the central component of Salesforce’s financial sector offering. It provides a single platform for managing client interactions, financial goals, and contacts across numerous media.

Einstein Analytics: Financial organizations can use this advanced analytics solution to personalize client interactions and make data-driven choices by integrating it with FSC to provide predictive insights.

Salesforce Shield: Salesforce Shield provides improved security and compliance capabilities, such as encryption, audit trails, and event monitoring, for organizations managing sensitive financial data.

Einstein AI: Salesforce has integrated artificial intelligence features that improve customer service and operational efficiency by automating tasks, anticipating customer needs, and making recommendations.

Possible Applications of Salesforce in Financial Services

1. Customer Relationship Management (CRM)

Salesforce’s ability to manage client interactions is aided by its 360-degree customer view. This holistic approach, which incorporates account information, transaction history, and interactions across all touchpoints, enables proactive engagement and personalized service.

Use Case: By leveraging FSC to track client portfolios, automate routine tasks, and identify investing opportunities, advisors can focus on high-value interactions.

2. Streamlining Operations

Financial organizations frequently handle intricate procedures that Salesforce can help to streamline. Task management, integrated systems, and workflow automation decrease manual labor and boost productivity.

Use Case: By automating the loan application process, a bank may utilize Salesforce to speed up response times and increase customer satisfaction. This includes document collection and approval.

3. Compliance Management

Salesforce’s compliance management capabilities, which offer safe access controls, data encryption, and audit trails, assist financial institutions in meeting regulatory requirements.

Use Case: Salesforce Shield is a tool that an insurance business may use to track data access and modifications and make sure that it complies with industry rules like the CCPA and GDPR.

4. Marketing and Sales Automation

Salesforce’s marketing and sales features enable financial organizations to create targeted campaigns, manage leads, and track sales performance—all of which contribute to effective client acquisition and retention strategies.

Use Case: Retail banks can deliver tailored marketing messages and offers to specific client segments by using Salesforce Marketing Cloud to segment customers based on their financial behaviors and preferences.

5. Customer Support and Service

Salesforce provides comprehensive customer support solutions, including knowledge bases, omnichannel assistance, and case management. Financial organizations can offer prompt and effective customer service with the use of these characteristics.

Use Case: Salesforce Service Cloud enables an insurance company to track client complaints, handle claims, and offer resolutions via chat, email, and phone.

Conclusion:

Financial organizations may manage client interactions, optimize operations, and maintain compliance with the aid of Salesforce for Financial Services, which provides an extensive tool suite. Financial institutions may use Salesforce to increase productivity, improve client experience, and maintain their competitiveness in a market that is changing quickly.

Adopting advanced technologies like Salesforce is crucial to maintaining competitiveness as the financial services sector develops. Salesforce provides the adaptability, scalability, and cutting-edge functionality needed for businesses in today’s changing market, whether they are banks, insurance providers, or wealth management firms.